Do artists qualify for the SBA disaster loan and $10,000 Emergency Grant? More importantly, should artists apply? The short answer is YES AND IT TAKES FIVE MINUTES DO IT ASAP. I will repeatedly link to the application in this article. Here’s some stuff you should know. Note: this is based on research on 3/27/2020 and was last updated on 4/16/2020. I have updated it periodically as new information emerges. Check the SBA.gov and the CARES Act for the most up-to-date information.

UPDATE AS OF 4/16/2020:

After receiving 3 million applications in the first week, the SBA unfortunately changed some of the rules of the game:

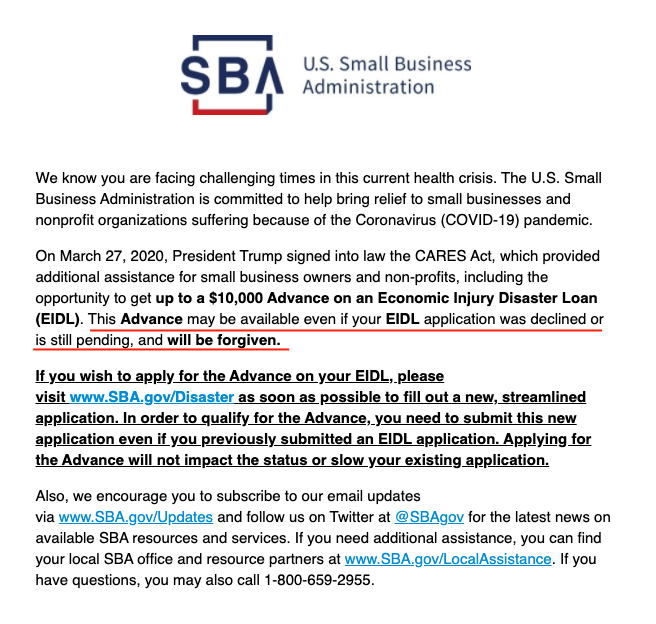

- Originally, the CARES Act expanded recipients of Emergency EIDL Grant to include the self-employed, sole proprietorships and LLCs with no employees, homeowners, and renters. The loan advances of up to $10,000 were supposed to be distributed within 3 days of applications.

- But due to the number of applicants, the SBA changed the rules to the following: “To ensure that the greatest number of applicants can receive assistance during this challenging time, the amount of your Advance will be determined by the number of your pre-disaster (i.e., as of January 31, 2020) employees. The Advance will provide $1,000 per employee up to a maximum of $10,000.”

- Additionally, the amount of the EIDL advance you receive cancels out a business’ loan forgiveness via the Paycheck Protection Program.

- In my opinion, this is an unfortunate change. First, $1,000 per employee can’t even keep one person employed at minimum wage for a full month (a minimum wage worker earns approximately ~$1,200 per month). Second, it cancels out the benefit of the PPP Loan to businesses that do have employees, so it basically nullifies the grant. Third, it continues to emphasize that those who have more money get more money. What could have been a stimulus for small businesses, microbusinesses, and local economies has been reduced in its impact based on a faulty “jobs” metric.

- There is a silver lining on this. Legally, if you are the owner of a sole proprietor or LLC or otherwise an independent contractor, you don’t count as an employee. The implication of $1,000 per employee is that many of the people the CARES Act expanded eligibility for just got canceled out. However, it appears that in implementation, the SBA counts one self-employed person as one “employee.” So if you’re self-employed and you applied early, you should still be eligible for $1,000. The applications are being processed on a first-come, first-serve basis. It currently looks like it’s taking about two weeks to distribute funds from the time of application. As of 4/16/2020, the SBA is no longer taking new applications for the EIDL advance.

- Other self-employed people I’ve talked to (single-member LLCs, sole proprietors, gig workers) who applied between 3/30 and 3/31 report receiving their $1,000 EIDL grants between 4/17 and 4/20. The SBA is processing applications first-come, first-serve.

BEFORE 3/30/2020: Here’s what you need to know about the EMERGENCY EIDL GRANT:

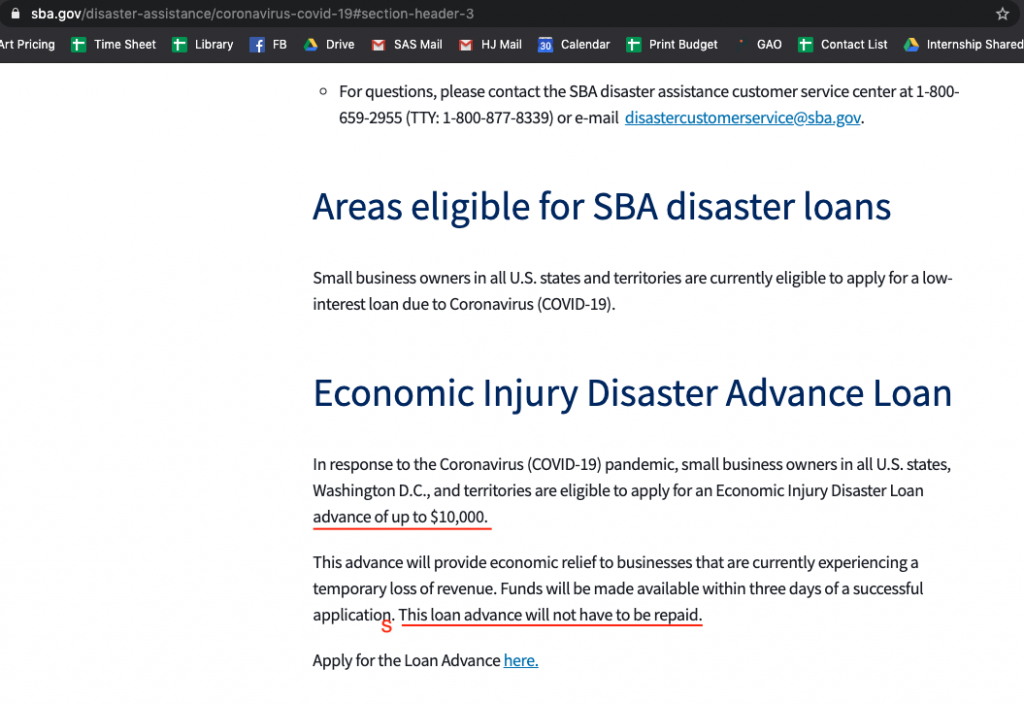

- When I first wrote this article, there was no info about the Emergency Grant on SBA.gov, so I had to pull it from the 880-page CARES Act. As of 3/30/2020, according to SBA.gov applicants to the Disaster Loan you can request an up to $10,000 Emergency Advance that does not have to be repaid.

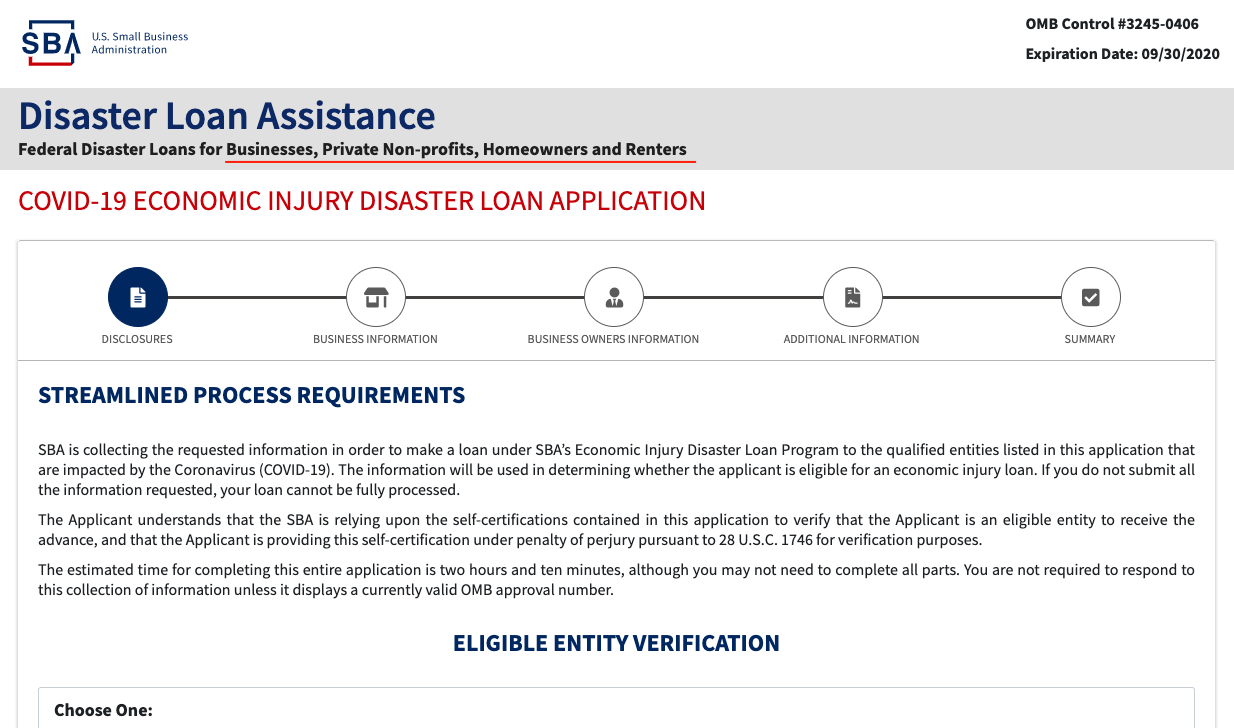

- Yes. You have to fill out the loan application. No, there is not a separate grant application. The application takes 5 minutes. Check the box saying you want the $10,000 advance. You do not have to repay the advance you receive.

- The terms of the Emergency EIDL Grant are outlined in the 880-page CARES Act that Congress voted on and Trump signed on Friday, March 27th. Pages 66-69 of the CARES Act outline the eligibility requirements for up to a $10,000 Emergency EIDL Grant. Businesses, nonprofits, sole proprietorships, and independent contractors with 0 to 500 employees qualify for the emergency grant of up to $10,000 per applicant.

- The grant’s intended use is for things like rent, accounts payable (e.g. utilities, suppliers), payroll, and other bills that can’t be paid because of the disaster’s impact.

- The total Emergency fund is $10 BILLION and SBA must distribute these emergency grants within 3 days of receiving your application. In other words, if you’re a freelancer, gig worker, independent contractor, small business, or nonprofit, you qualify. The grants will be awarded within 3 days of your application and they are expecting an influx of applicants, so the sooner you apply, the better. UPDATE 4/2/2020: the SBA website now says that it will take about one week to process your application.

- You can get the grant even if you get denied for the loan. You can get the grant even if your loan application hasn’t been processed yet.

- Compare $10 BILLION to the $75 million the National Endowment for the Arts is receiving for relief funds, which isn’t nearly enough (the museum industry alone needs $4 billion in aid to keep afloat). This is literally 133 times higher than the NEA funding, which will go to arts organizations, not to artists or other freelancers. ARTISTS, go after the bigger pie.

Here’s what you need to know about the DISASTER LOAN:

- The Small Business Administration Disaster Loan is a 3.75% loan for businesses, nonprofits, renters, and homeowners impacted by COVID-19 qualify to apply. The loan interest rate for nonprofits is $2.75%.

- You may qualify for loan forgiveness for expenses incurred in the first 8 weeks of receiving the loan if you use the funds for payroll, interest on mortgages, rent, and utilities. Loan forgiveness means you don’t have to pay it back, but it should not be confused with a grant.

- Businesses and nonprofits with 0 to 500 employees could qualify for an up to $2 million loan. The maximum interest rate after this year is 4% and doesn’t have to be paid back for 30 years.

- Any part of the SBA loan not used for payroll, interest on mortgages, rent, and utilities does not qualify for loan forgiveness. Read a summary about the terms here.

SHOULD ARTISTS TAKE THE LOAN? Most independent artists are going to be either sole proprietors or the owners of LLCs. So here’s the catch for sole proprietors and LLCs when using the SBA Disaster Loan:

- Again, the Disaster Loan can be used for payroll, interest payments on mortgages, rent, and utilities.

- As a sole proprietor or the owner of an LLC, you are not considered an employee. You are self-employed and therefore not on payroll. If you have an LLC, you are classified as the owner, not an employee, which means you get paid by making draws out of the company’s profits, not on salary.

- This means that most artists will not be able to get loan forgiveness if they pay themselves using the loan, even if it matches what they pay themselves normally. They only qualify for loan forgiveness for interest on mortgages, rent, and utilities.

- Getting help with your interest payments on mortgages, rent, and utilities is great, even if you can’t pay yourself. Loan forgiveness only applies to expenses over the first 8-week period from when you receive the loan. That means in order to get $10,000 of loan forgiveness, you need to be spending $5,000 a month on mortgage interest, rent, and utilities, which most artists are not. Realistically for most artists (e.g. freelancing visual artists, musicians, performers), this will be a $2,500-$5,000 loan forgiveness and a $5,000-$7,500 loan you have to pay back depending on how high your forgivable expenses are.

- With all that said…

Final Assessment: Should Artists Apply?

ABSOLUTELY YES. The only way to get the Emergency Grant is to apply for the loan and if you’re reading this I’m guessing $10,000 would be amazing right now. If you take the loan, too, treat it like you would a credit card. This is a 3.75% loan, which is very low, and you have the rest of the year to pay it off. If you don’t pay it off right away then it carries a maximum 4% interest rate beyond this year, and you don’t have to pay it back for 30 years. The average rate of inflation is 3% per year, so a 4% interest rate loan is honestly really good.

If you get the loan, be cognizant that if you’re a sole proprietor or you own an LLC you can’t pay yourself with this money, so be mindful of that when using the funds. Treat it like a credit card that earns you points and be prepared to pay some or most of it back.

IMPACT

As of 3/30/2020 this article has been read 1,437 times. Wow! I’m glad this is having an impact. If just 10% of readers applied for this grant, then potentially $1.44 million just went to artists!! That’s twice as big as Wisconsin’s state arts budget, which, let’s be real, contributes very little to artists’ pay.

Are you applying for the grant after reading this article? Take one minute to fill out this Google Form. This will help me get an estimate on how many artists/arts orgs/freelancers/small businesses applied for this grant after reading this article. I will write a follow-up article with stats on what kind of economic impact that had on the arts compared to typical arts funding available. If you’ve read my other posts, then you already know that arts support is pretty paltry. Let’s prove how much better we can do.

Cited Sources:

- Coronavirus Aid, Relief, and Economic Security (CARES) Act, Final Document as of 3/27/2020

- US Small Business Administration (SBA.gov)

- SBA Loan Application

- What Businesses and Lenders Need to Know About the CARES Act, by Bryan Cave Leighton Paisner Law

- New $2 Trillion Coronavirus Relief Bill: What It Means for You and Your Business, by KJK Attorneys

- What The $2 Trillion Stimulus Means for the Arts, Struggling to Stay Afloat, Hyperallergic

Why am I spending hours of my life obsessing with the SBA Loan? Frankly, I’m mad at the lousy support artists receive in good times and how quickly artists are left out of the picture during bad times. I’m also a details nerd and obsessed with efficiency and high impact for effort. So I’m providing my homework on the SBA Loan to you publicly as a resource because society doesn’t tell artists what they qualify for. Most artist relief funds are gonna be $500 to $2,500. I want all of you to go for the $10,000 nobody is telling you about. Get the bigger pie.

This is for our community and all the helpers. Thank you to all the helpers. Stay strong, everyone.

Fantastic job describing these resources, Jenie! Many thanks for sharing this.

Thanks for all of your effort, Jenie!

Thank you for this article! I have seen in a couple places that the $10,000 grant would be able to cover expenses related to contractors, and in a couple other places that it could cover accounts payable (which, I imagine, could also go toward contractors), and that these expenses would also qualify for forgiveness. Do you have any information on this?

Thanks for all your information Jenie. It’s very, very helpful. I am an artist with 4 employees, and this spells things out for me.

Under ‘Business Activity’ I don’t find a category that I fit neatly into. I am an artist who makes paintings and prints, package and/or frame, and sell direct to the public at fine art shows or at my studio or online. Does Manufacturing or Retail seem to be the best fit? Or, ‘Entertainment Services’ seem to be a better fit?

I have filled out the loan information. There is no submit button. where do we send the application too?

The categories are pretty limited. Manufacturing retail and Entertainment Services are both fine. Pick whatever feels closest.

According to SBA.gov they just say it doesn’t have to be repaid. Read the CARES Act if you want to know more.

Pretty sure I miscalculated my “Costs of Goods Sold”. Hopefully, we’ll have an opportunity to edit or amend our application at some point. I literally used the costs of materials and excluded overhead, as I am an artists and not an accountant 🙂

The submit button should be on the last page of the application.

thanks Jenie, i sent you an email, with a breakdown of more resources to share, hope its helpful L

Thanks, Jenie. Thank-you for doing such homework as you did, to find all this out.

Yep….I filled it out…sent it in…now we wait.

Thanks Jenie, for posting all of this info. It was a great help – I’ve applied.

Hi guys. Thanks Jenie for sharing this. I did mine and I never got a confirmation that it was received or anything. Was this the case with everyone else? Im probably s.o.l. at this point. since its all gone. But I did it on the 8th. i was hoping I would have at least got a received or something notice.

Hi, Dave! From conversations with other folks most people haven’t received any emails from SBA. However, people who applied on 3/30 and 3/31 just received their deposits between 4/17 and 4/20. The SBA changed the rules after receiving 3 million applications (they could not process them in the original, promised 3-day turnaround) and are now giving $1,000 per employee. They are counting single-member LLCs and sole proprietors as one employee. So if you are self-employed and have no employees, you should be receiving $1,000. The SBA is processing the applications in order, first-come first-serve. I hope the money lasts and they reach later applicants as well. Good luck!!